The conference was well-attended, with over 200 delegates, including high-level government ministers and officials from the Democratic Republic of the Congo (DRC) and Indonesia. Also present were a number of Cobalt Blue’s existing and potential commercial partners, including Iwatani Australia, who attended key meetings and discussions with us.

The overall tone of the conference was broadly optimistic with market participants across the cobalt industry hopeful of an improvement in global supply and demand dynamics, and thus pricing.

The DRC’s ban on cobalt exports

On 22 February this year, the DRC government suspended the export of cobalt products for four months, citing a need to realign exports with global demand. At the time of the announcement, the DRC’s minerals regulator said it would review the ban three months after the announcement. The DRC government has since said further guidance on the suspension of cobalt exports will be provided in the first half of June 2025 following discussions with industry.

DRC government officials who attended the Cobalt Institute Congress explained that the export ban was part of a measured strategy that will enable the government to transform the sector. Significant considerations include controlling artisanal mining activities, improving transparency of the supply chain, and resetting the DRC’s commercial relationship with China.

Market Outlook

Various market presentations were given, including Benchmark Minerals Intelligence, CRU and Shanghai Metals Markets. The consensus view is that the initial price increases were likely a knee-jerk reaction to the export ban, rather than being based on physical market dynamics. Given that cobalt inventories along the vast supply chain from central Africa to China, from road to consumer, do not yet appear to have been exhausted, the real supply squeeze is about to start. In short, industry analysts expect prices to resume their upward climb in the coming months.

Providing a positive longer-term outlook, the Cobalt Institute’s Annual Market Report was delivered at the conference. It forecasts demand for cobalt will rise faster than supply, allowing the market to reduce the 2024 surplus in coming years and swing to a deficit in the early 2030s. According to the Cobalt Institute, prices are likely to rise throughout this period.

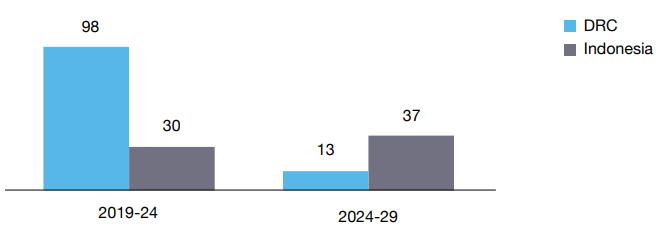

Cobalt supply growth from the DRC and Indonesia (kt) is set to significantly slow

Cobalt Blue Participation

The Cobalt Institute invited Andrew to take part in a panel entitled “Capitalising on opportunities: How policy and finance can work together to support resilient cobalt supply chains.” Andrew shared his thoughts on improving the pipeline of new projects while finding a balance in working with the existing, DRC-dominated supply chain.

Our updated corporate presentation is available at the link below.