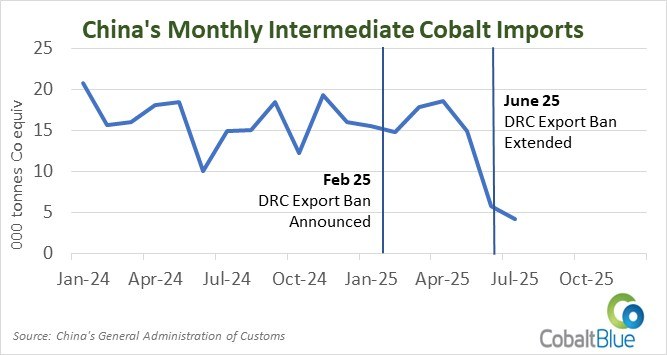

Why did this trend take so long to show up? The supply chain, from the DRC to its primary customer, China, is 4-6 months long. Essentially, it's been ‘business as usual’ with adequate supply throughout this period.

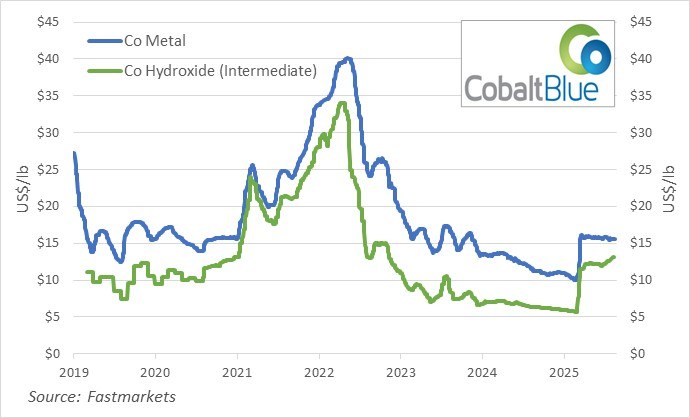

Cobalt metal and hydroxide (intermediate) prices spiked 60% immediately after the ban was announced. The metal price has since plateaued, and while the hydroxide price has shown some signs of life in the couple of months, it still has hardly moved.

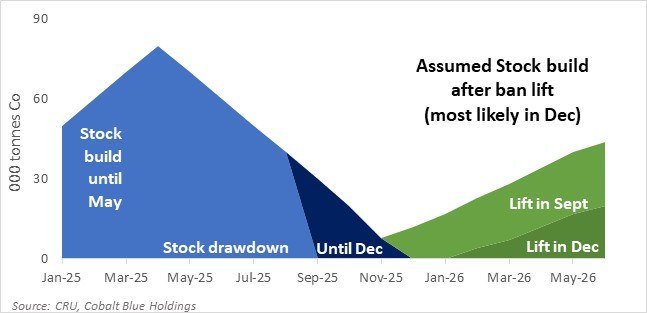

Trading volumes in July and August tend to average much lower than normal in the northern hemisphere summer months. However, we suspect that as seasonality eases, market participants will be faced with much lower inventory across the supply chain and would expect a much more competitive pricing environment.

The next market milestone to look out for is an update from the DRC government in September on whether they will extend the export ban. Given the lack of price support, an extension could be expected. What price is the government looking for? According to Gecamines (state-controlled miner and trader) Chairman Guy-Robert Lukama, Congo doesn’t want a return to peaks above $40 a pound — experienced in 2018 and 2022 — but “it was our duty as a country to stabilize the price.”

Commercial Manager Joel Crane talked with Proactive about these cobalt market trends. Link to video here.