_______________________________________________________________________________________________________________

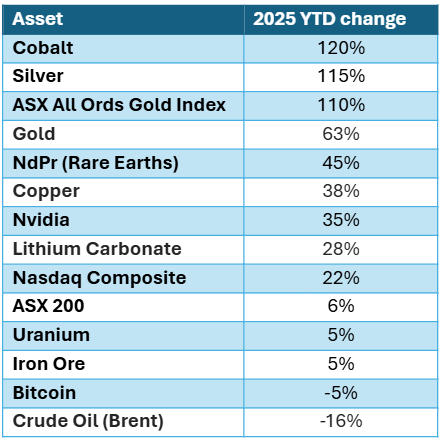

2025 in Review

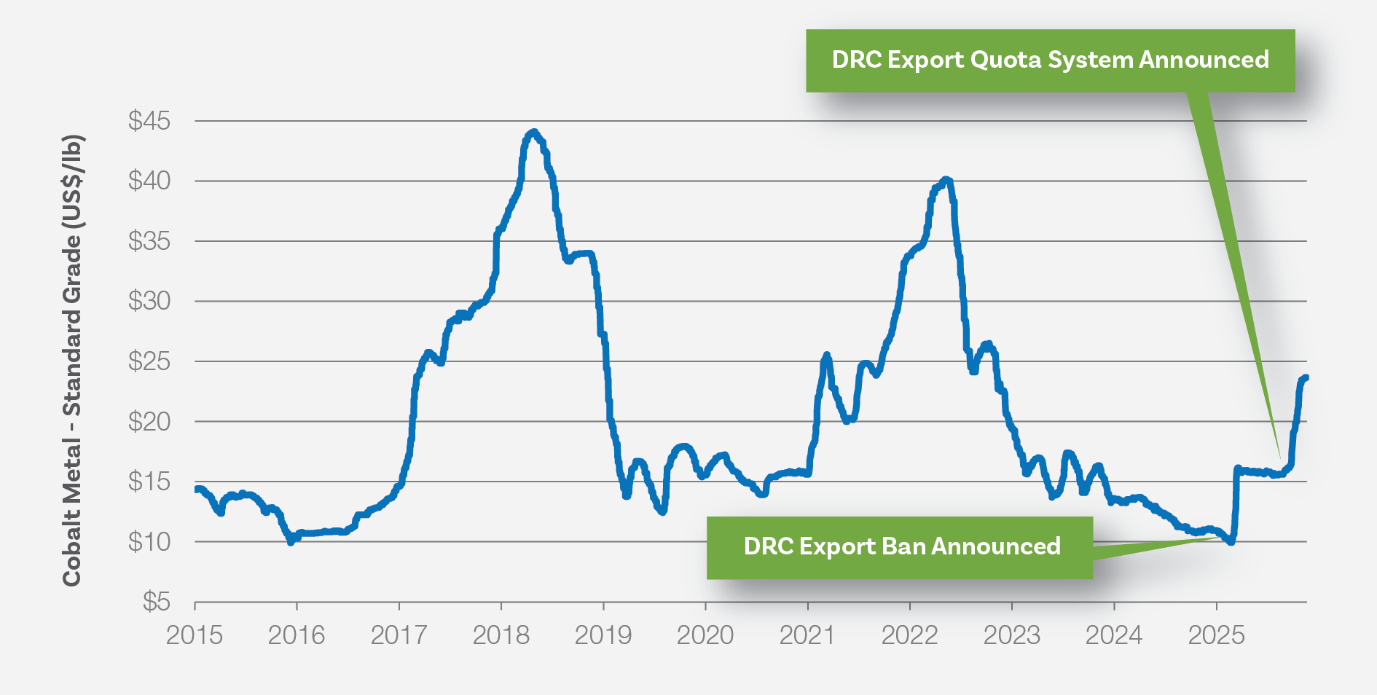

Prices Hit Record Real Lows

In January, cobalt fell to a real ($2024) record low of US$10.70/lb (US$23,590/t) as the market grappled with significant oversupply. Between 2021 and 2024, global supply grew at a 15% CAGR, nearly double the 8% CAGR in demand. Much of this surge was driven by stronger-than-expected output from the DRC, particularly from newly commissioned, Chinese-backed projects.

DRC Intervention: A New Era of Market Management

The depressed price environment prompted the DRC government to impose an export ban in February 2025. The country’s mineral regulator cited widespread illegal mining and chronic oversupply, stressing that “exports must align with global demand.”

The initial reaction was swift: cobalt prices jumped roughly 60% before stabilising as inventories and the typical 4-6-month DRC-to-China supply chain cycle absorbed the disruption.

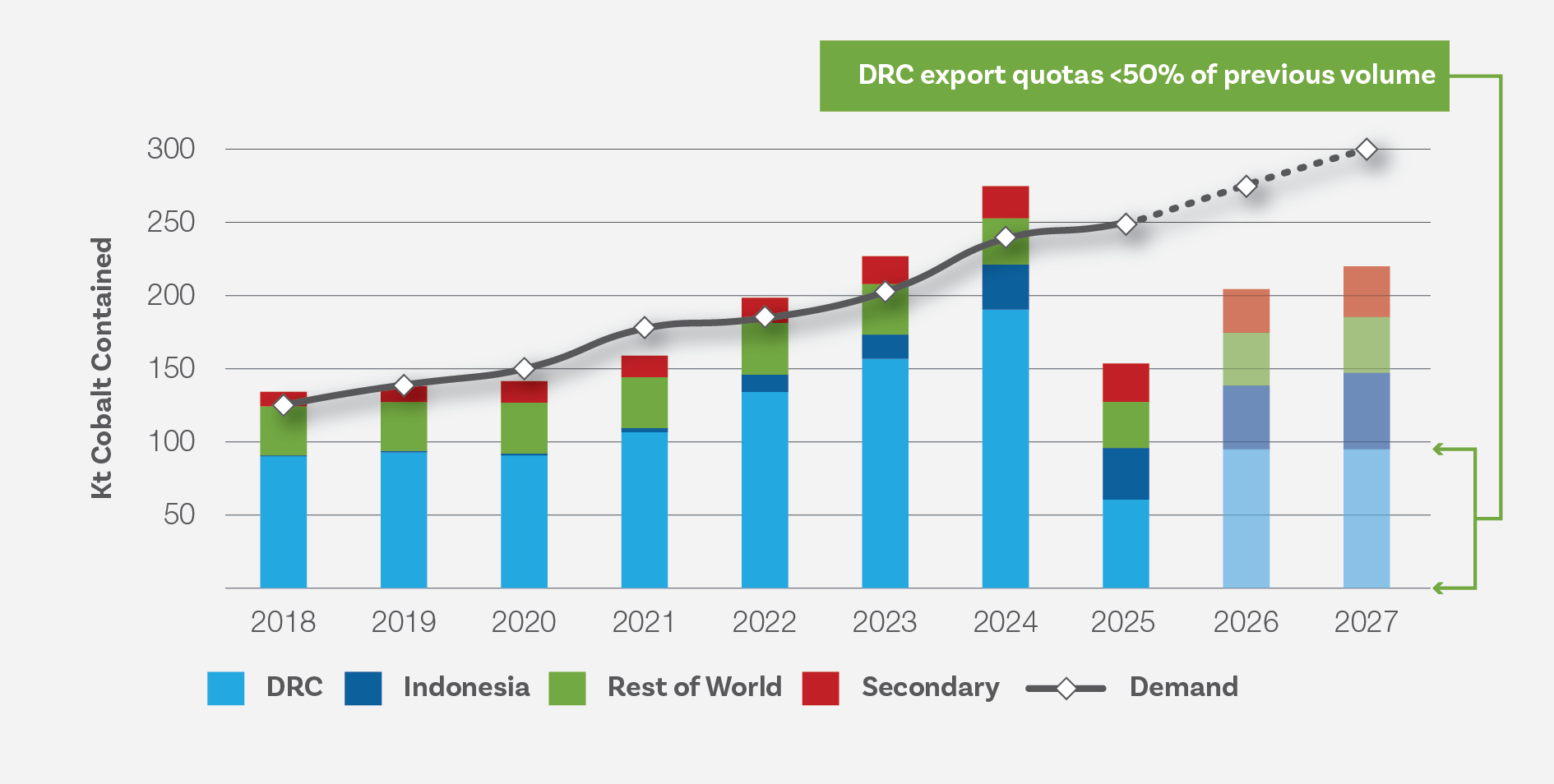

Phase Two: Export Quotas Replace the Ban

In September, the DRC replaced the export ban with a new export quota system set to remain in place until at least 2027. The approved export volumes amount to less than half of the country’s 2024 production, signalling a multi-year tightening of supply.

Prices rallied again in the wake of the export quota, rising a further ~50%, as the market priced in sustained shortages.

A Supply Chain at a Standstill

Although exports have technically been allowed under the new quota system since 16 October, administrative bottlenecks, including verification certificates and other regulatory requirements, have slowed the restart. In the first half of December, the two largest miners, Glencore and CMOC, began moving small test shipments to validate the new procedures.

As a result, material is unlikely to reach Chinese customers before March 2026, keeping supply tight well into the first quarter.

________________________________________________________________________________________________________________

2026 Outlook

With customers set to enter the new year having received almost no DRC shipments for 12 months, the global cobalt balance will begin 2026 in a particularly constrained state. The price gains achieved in 2025 are likely to hold—and may strengthen further—as refineries compete more aggressively for limited feedstock.

Consensus forecasts call for an average cobalt price of US$25/lb in 2026, easing modestly to US$23/lb in 2027, reflecting expectations of a structurally tighter but gradually stabilising market.

Potential Further Intervention

The DRC government is expected to watch market conditions closely and, wary of price related demand destruction, may act if prices exceed US$30/lb for an extended period. An increase in export quotas is the most probable policy response.

Demand Continues to Evolve

Cobalt demand remains on a growth trajectory:

- Electric mobility is the fastest-growing segment, with multiple lithium-ion battery chemistries relying on cobalt to stabilise voltage and extend cycle life.

- Defence and aerospace applications are also emerging as increasingly important contributors to demand growth.