The Democratic Republic of Congo (DRC) announced on 20 September that it will lift its suspension on cobalt exports, effective 16 October, replacing it with a quota system to remain in effect until at least 2027.

According to the announcement from ARECOMS, the country’s regulatory and control authority for strategic mineral markets, a maximum volume of 96,600 tonnes of cobalt will be authorised for export. Of this, 9,600t will be earmarked as a “strategic quota” allocated to ARECOMS, which will have sole discretion over its distribution.

The quota allocation will be “calculated on a pro rata basis using historical export volumes.” We interpret this to mean that each company’s export market share will be assessed from a specific reference period and allocated accordingly. This approach may also leave room for companies to negotiate their share.

Importantly. ARECOMS added that quotas could be revised in the case of a “significant imbalance in the cobalt market.”

It also warned that it can withdraw the initial quota allocated to any company that fails to comply with applicable laws and regulations. In addition, ARECOMS “reserves the right to organise the purchase of cobalt stocks that exceed any company’s quarterly quota allocation.”

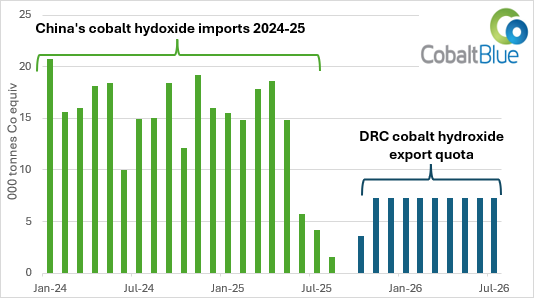

Putting the quota into context: This new system will equal just 7,250 tonnes a month available for export. In the 17 months before the impact of the export ban. China’s cobalt imports averaged 16.2kt per month.

What happens next? After more than 7 months of the export ban, refinery inventories have reached critical levels. Even though exports will resume in October, the earliest shipments will reach China by January, keeping the cobalt market tight and highly competitive for the next 4–6 months and creating strong upside pressure on prices.

What are the longer-term implications? If quotas are strictly enforced, refiners will be competing for less than half of normal availability. This would push the global cobalt balance from surplus to deficit in 2026, with the potential for a sharp price response.

However, the new framework gives ARECOMS considerable flexibility. The regulator can adjust quota volumes and purchase cobalt stocks exceeding a company’s allocation, effectively controlling how much material reaches the market. These levers provide powerful influence over price direction and may be used to prevent a prolonged return to +$35/lb levels, which risk triggering demand destruction in the battery sector.

While this marks the early stage of a structural shift in cobalt market dynamics, the DRC has clearly positioned itself to manage both producer and consumer inventories – and by extension, price stability. The “sweet spot” for pricing will be one that maximises government revenue without undermining demand, likely anchored around the long-term real average of ~$26/lb.